FIRST GREEN BANK'S REGENERATIVE CHALLENGES

the challenge: The Living Building ProjectFirst Green Bank is working hard to green the built environment through a variety of creative lending strategies. The Year in the Life introduced the bank to Stuart Cowan, a consultant to the country’s first commercial Living Building. FGB CEO Ken LaRoe is now committed to building one or more Living Buildings in Central Florida. Will it be possible?

Visit our blog to read the continuing story of First Green Bank's Living Building Challenge |

Mentor Stuart Cowan Plants the Seeds of the Living Building“How can we begin to solve for the gap between what appraisers can and cannot value today in their projects, versus what that underlying deeper sense of value might be?" Moving from the LEED to the Living BuildingAnyone who walks into FGB's Mt. Dora LEED Platinum branch is immersed in a regenerative built landscape. Inspired by the Bullitt Center in Seattle, FGB now aspires to build a new facility for its Clermont Branch that is truly a "Living Building." Our Visit to FGB with Mentor Stuart CowanOur first visit to First Green Bank, with Year in the Life mentor Stuart Cowan, exceeded our expectations in every way imaginable. Design-Builder Brian Walsh on the Living Building ChallengeWalsh invokes the language of regenerative design to describe the project. Setback for the Living Building ChallengeDeveloper and FGB part company; team hopes a better site will be found. |

the challenge: Meeting Investor ExpectationsFirst Green Bank’s investors are a diverse group—some large, some small; some more focused on financial returns; others more on the bank’s values proposition. Here we meet some of them and find out what motivates them to be part of the FGB investor community. Can the bank successfully manage this broad spectrum of investor expectations?

|

First Green Bank Investor and Board Member: Randy Strode"FGB client & board member Strode’s practices regeneration in his own business, AgriStarts. As a FGB investor he hopes his financial returns will come when First Green is sold to a values-based bank." Evangelical Minister and First Green Bank Board Member Joel Hunter"There has also been a certain amount of conflict on the board of directors and I see myself in a peacemaker role there." David Raab, President of Roseville Farms & FGB Investor"Kenny has proven that values and banking are not mutually exclusive." Jim Gissy, VP, Westgate Resorts and FGB investor“I like the idea that their focus is thinking about sustainability of the environment. What good will it do if the environment is screwed up? It won’t matter how much money you have.” Marc and Terry Godts, owners of Green Isle Gardens...were not looking for short-term profit—but to make a long-term investment in their community and in a business they knew was aligned with their values—when they became shareholders in First Green Bank. |

the challenge: Creating a Holistic-Values Banking Culture

CEO Ken LaRoe is always searching for creative ways to evangelize the bank's holistic-values mission among staff members. Is he succeeding? How does bank staff experience that values mission in their work and personal life?

the challenge: Banking the UnbankedFirst Green Bank started out with a strictly environmental perspective on values-based banking, but has expanded its mission to include social impacts. This year the bank is empowering staff to contribute to developing a formal financial inclusion program. How will FGB manage the associated risks while helping to bank more of the community's unbanked?

|

AMANDA RICHAmanda Rich grew up in Knoxville, Tennessee, near the heart of the Smokey Mountains, hiking around the rivers and lakes, and falling in love with nature. ANNETTE SNEDAKER“I guess Ken thought that if I could get people to go to church in this day and age, I might be able to help people live deeper into First Green Bank’s mission and build relationships with us based on that.” FGB Credit Analyst Justin Allender"I am not saying we put the environment ahead of the economy. I am talking about making ethical and moral decisions as part of our economic decisions." FGB Teller Jessica Schwarz"We see this new account as our way of being there for people in our community who are living paycheck to paycheck." Nancy Little, Winter Park Branch Manager“What the bank does in the community really speaks to me. I feel it has made me a better person." Kelly Krusoe“We are all trying to make a difference in the community, to be focused on sustainability and not just on making money." |

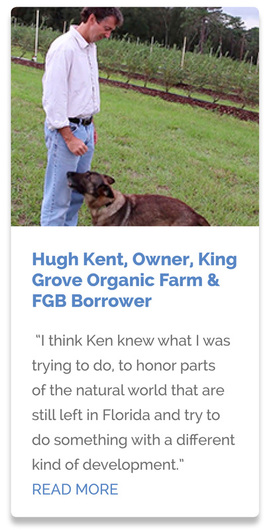

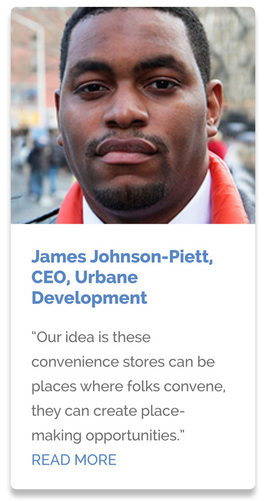

the challenge: Cultivating Regenerative Borrowers

First Green Bank actively seeks out borrowers who are committed to triple- bottom-line practices. Can the bank increase its regenerative portfolio over the course of the year? We meet some of those social entrepreneurs and find out how the bank supports them on their journey to become truly regenerative entrepreneurs.

|

the challenge: Convenience Store ConversionFirst Green Bank lends to convenience stores, generally considered part of the extractive economy. The bank has ambitions to work with a convenience store owner to undertake a “green” conversion that would become a model in the state.

|

the challenge: Regenerating an Economy in Transition

First Green Bank hopes to play a regenerative role in the economic transition of Lake County—a rural county now vulnerable to extractive development. Lake County leaders provide the backstory on the challenges the bank will face.

|

A County Commissioner Reflects on an Economy in TransitionTo begin our Lake County “story of place” we speak with Welton Cadwell, a 23-year veteran of the Lake County Board of Commissioners. An Organic Farmer Tells a Cautionary TaleHugh Kent, owner of King Grove Organic Farm, says he is deeply troubled by changes in the political and economic landscape in Lake County and Central Florida. Michelle Thatcher, CEO and co-founder of the U.S. Green Chamber of CommerceMichelle Thatcher has crafted an outreach program for the Green Chamber that is carefully tailored to a business community that may not always be initially receptive to its message. Economic Growth Director, Robert Chandler“You battle with how do you manage the growth versus seeing the dollar signs in just letting it happen?” |